How to complete and file irs form 8829 Form signnow sign business Publication 587: business use of your home; day-care facility

Gain Derived from Business Use of Home | airSlate SignNow

Form worksheet tax tips ppt irs worksheets agents estate business use real deduction office Form 8829 deduction office line fill claiming part business total U.s. tax form 8829—expenses for business use of your home

Irs percentage blueprint determines expenses

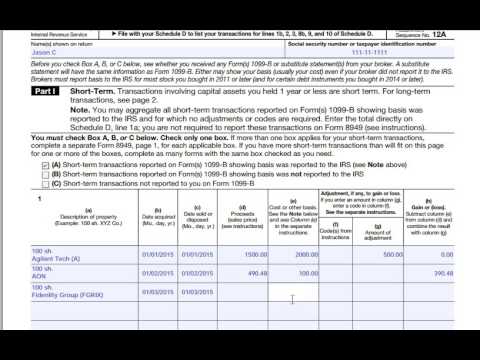

8829 simpler taxes deduction adjuvancy8829 pdf 2020-2024 form U.s. tax form 8829—expenses for business use of your home8949 irs tax.

8829 deduction claimingWorksheet. form 8829 worksheet. worksheet fun worksheet study site Freshbooks expenses calculateHow to complete and file irs form 8829.

How to claim the home office deduction with form 8829

8829 irs deduction blueprint standard deductCorey tax — how to fill out irs form 8949 here is tutorial... How to fill out form 8829 (claiming the home office deductionForm 8829 office irs deduction use do taxes business expenses gusto claim fill.

Expenses freshbooksIrs 8829 worksheet expenses pdffiller deduction taxable fillable simplified federal signnow templateroller Expenses irs deduct someForm 8829 simplified method worksheet.

Irs facility

Gain derived from business use of homeHow to complete and file irs form 8829 How to fill out form 8829 (claiming the home office deductionForm simplified method worksheet instructions help.

.

Gain Derived from Business Use of Home | airSlate SignNow

U.S. Tax Form 8829—Expenses for Business Use of Your Home | FreshBooks Blog

8829

How to Complete and File IRS Form 8829 | The Blueprint

How to Fill Out Form 8829 (Claiming the Home Office Deduction

How to Complete and File IRS Form 8829 | The Blueprint

8829 PDF 2020-2024 Form - Fill Out and Sign Printable PDF Template

corey tax — How to fill out IRS Form 8949 Here is tutorial...

Publication 587: Business Use of Your Home; Day-Care Facility